The trading method is an amalgam of strategies; a blend of pitchforks for trade direction and volatility combined with some trade entry methods based on other’s successful strategies.

After so many years, South Ocean has learned that almost any method with reasonable  probability will succeed if applied rigorously. None of the South Ocean methodologies are proprietary; they are all in the public domain in one form or another.

probability will succeed if applied rigorously. None of the South Ocean methodologies are proprietary; they are all in the public domain in one form or another.

The Setup.

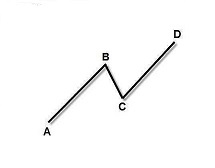

The setup is based on an ABCD pattern, looking first for the A-B move followed by a correction to point C, then trading the move from C in the same direction as the A-B leg.

Sometimes this pattern is called the Measured Move. You can find published descriptions using this measured move in Joe DiNapoli’s Trading with DiNapoli Levels and in Robert Miner’s Dynamic Trading. They both offer software packages designed around their specific systems. Clyde Lee (1931-2010) was a mathematician and geologist. He built some Tradestation software programs that described the Andrews Pitchfork and implemented a version the Hurst Cycles which we still use today. The pitchfork is another form of the ABCD pattern with some trend elements. Ira Tunik was an options floor trader in the 1980’s and has his own version of the various cycles and target levels.

So, we try to use bits and pieces of all these systems and incorporate them into the South Ocean trade planning process.

South Ocean uses three time frames to determine trade direction and the pressures that contribute to this direction. The highest time frame is a reference for these directional pressures, the middle time frame is the trading time frame and the lower time frame is used to trigger the trade.

Trigger the Trade.

Once a Point “C” is identified, then an entry must be triggered and a stop must be set. Everyone has different triggers. South Ocean prefers to trade with the trend. We like the DiNapoli method of looking for a trend with the MACD, and once that is established wait for a Slow Smoothed Stochastic to cross in the direction of the MACD. South Ocean also uses a Dynamic RSI developed by Mark Jurik to judge trade entries.

Once a Point “C” is identified, then an entry must be triggered and a stop must be set. Everyone has different triggers. South Ocean prefers to trade with the trend. We like the DiNapoli method of looking for a trend with the MACD, and once that is established wait for a Slow Smoothed Stochastic to cross in the direction of the MACD. South Ocean also uses a Dynamic RSI developed by Mark Jurik to judge trade entries.

This South Ocean website is not going to teach these methods, but Charlie “Says” will setup specific trades and post the planned entries and exits as they present themselves.

As an example: Let’s look at a recent Trade Setup of the ETF, EUFN ( the Euro Financials) on Feb 3rd, 2015.

“Trade pressures are neutral. Volume is neutral. Hitting resistance at the 25×5.

“Trade pressures are neutral. Volume is neutral. Hitting resistance at the 25×5.

the long entry is 21.60 with a 22.96 first target. Intraday has 4 hrs of bullish volume.

can take the trade with a 21.00 stop,

[update 2-6-2015] @ the 2 hr target of 21.78 and has changed to uptrend on the Daily.”

Then another look on 2/15.

“Trade pressures still neutral. Weekly volume has been bullish for two weeks. Daily volume has turned bullish after three days of a pullback, closing at 22.59 near the first target of 22.96.

“Trade pressures still neutral. Weekly volume has been bullish for two weeks. Daily volume has turned bullish after three days of a pullback, closing at 22.59 near the first target of 22.96.

South Ocean first moves the stop to the entry price of 21.61 and then would take this first target gain at 22.96 as the momentum indicators seem listless. The trade has no risk now with the stop at the entry price. Review the indicators again when price reaches target and make the sell decision.”

The exit comes on Friday, Feb 20th.

“Weekly – three weeks of bullish volume. A close above 23.56 would change the weekly trend to up. The announcement of the short term debt extension for the Greeks firmed up the move.

“Weekly – three weeks of bullish volume. A close above 23.56 would change the weekly trend to up. The announcement of the short term debt extension for the Greeks firmed up the move.

So, this Daily move up is still a correction in a weekly down trend.

Daily – Volume is bullish. Trade pressures are up. The trade has closed above the 22.96 target. The temporary nature of the Greek financing agreement makes us believe we will see another move down and then look for a longer term move up from this expected correction. So, this target was the trade exit. The next target up would be 24.37. We could wait but the first target has a higher percentage of success with the upper time frame not confirming the trade time frame.”

So a long entry at 21.61, an exit at 22.96, with good trade management produces $1.35 (6.2%) gross profit in less than 20 days.